How New York’s brand new free tax filing system will work this year

Companies like TurboTax have spent decades lobbying against this very moment.

Tax season is coming and that means it’s time for you to settle up with Uncle Sam to see if you owe him money to pay for the endless war machine, corn subsidies, WIC and big federal grants that pay for mass transit. Or maybe the government even owes you money. Either way, 2024 will be different because for the first time ever, the Internal Revenue Service is going to offer a direct file option that allows you to file your taxes for free, without a middle man frequently trying to upsell a filing program advertised as being "free."

You won’t be surprised to learn that Big Accounting Program Companies Hate This One Weird Trick To File Your Taxes For Free, and they have spent decades fighting to prevent this day from coming and charging you as much as $89 if you need a hand with your taxes. ProPublica has a great blow by blow of things like how online tax filing companies kept their free services hidden from web searches, restricted the pool of taxpayers who were even eligible for the free service, ran aggressive upsell campaigns inside the free service, and on and on.

But this year, tens of thousands of people with a relatively simple tax return in New York and 12 less important states will be able to file their federal taxes directly to the IRS, and everyone in New York and three less important states will be able to drop their state returns using the same free service. You will, however, have to wait until as late as March to use it.

Who can use it? (not everybody, yet)

Unfortunately for you, government loves a pilot program and a pilot program means phased rollouts. To qualify for the pilot this year, you’ll have to have a relatively simple tax return, limited to W-2 wage income; SSA-1099 Social Security and RRB -1099 railroad retirement income; 1099-G unemployment compensation; and 1099-INT interest income of $1,500 or less. If you itemize your deductions, and claim credits other than the Earned Income Tax Credit, Child Tax Credit or Credit for Other Dependents, the pilot won’t be for you. Obviously that leaves out the self-employed, among others, but this year’s offering is also just a pilot.

If you’re one of those Flanderses who wants to file as soon as the calendar turns from December to January, you’ll have to wait for the IRS to slowly open the pilot up to more and more people. According to the agency, the phased rollout is invitation-only and moving slowly through Presidents’ Day weekend, the IRS thinks it will be completely rolled out by mid-March. However, the agency said it will expand the pool of eligible filers based on the program successfully allowing people to file and access customer support, and not causing problems with state tax integration or fraud.

The pilot will offer real-time customer service and support in English and Spanish, and the website will be accessible by computer, spacephone or tablet. The feds are taking care of their own tax filing tech, while in New York, the computer nerds with hearts at Code For America will be handling the buildout for the state tax filing, according to a press release from Governor Kathy Hochul's office.

Even though you can't file just yet, you can still sign up for an account with the IRS to be ready for the day when you can be part of the incredible future of not paying to file your taxes. An account requires a driver's license, non-driver's license state ID or a passport, which you need to submit a photo of. You also need to take a selfie that the IRS processes through a rotoscope that makes you briefly look like you're in "A Scanner Darkly."

I thought I could already file for free? (Yes, but not like this)

Direct File differs from the existing Free File service run through the IRS because Direct File will be run by the IRS itself. Free File relies on IRS partnerships with and programming services from a lineup of various tax filing services, but each service has restrictions on who can use it and doesn’t always offer free state filing. In New York, four out of the eight available online tax filers in the Free File service offer state and federal tax filing for free, but each service is income-restricted.

Even with a limited pilot that rolls out in phases, the debut of Direct File makes good on a longtime dream of a diverse cast ranging from Ronald Reagan to Barack Obama to the current champion of the effort, Elizabeth Warren. The Massachusetts senator has been pushing for a free-to-use IRS-run tax filing option since 2016, when she noted that other countries allow their tax agencies to send pre-filed tax forms to their citizens who can proofread and sign off on the payment.

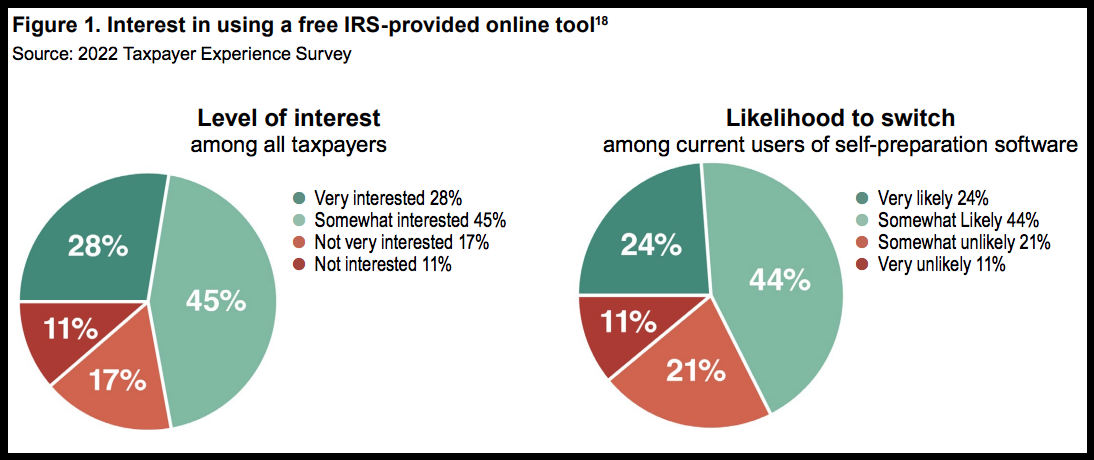

The pilot finally got some juice a couple of years ago when Congress included a provision requiring a feasibility study of the policy in the 2022 Inflation Reduction Act. That study revealed, surprise, that the IRS knows how to run a free tax filing program. The study also found that a good number of taxpayers would prefer to file directly to the IRS, especially after they got to mess around with a prototype tax filing program the agency put together.

A whopping 72% of taxpayers surveyed by the IRS showed interested in a free direct file service run by the tax agency, and according to the agency report “interviewed taxpayers reported that the software exceeded their expectations in terms of ease of use and simplicity” after people used a prototype of the Direct File tool.

Profit-motivated online tax preparers lobbied hard against Direct File by suggesting Americans didn’t trust the IRS to prepare and also process taxes. But it turns out Americans suggested they would love that shit, rather than spend time figuring out if TaxesPlus from Turbo Hacks is different from TaxesPlusTurbo. Still, Intuit has kept up the lobbying with aboveboard tactics like suggesting Direct File could lead to more audits of Black taxpayers, which was a misrepresentation of the work of a researcher who actually suggested that free filing run by the IRS could cut down on the number of audits of Black Americans who claim the EITC.

So even if you think the IRS is staffed exclusively by people who are like this guy (who in real life is not a vengeful tax man but a paterfamilias of a second generation of professional wrestlers), just think of all of the awful suits you'll be sticking it to if you go with the free government service.

Comments ()